When you are a nonresident alien performer otherwise runner doing otherwise doing sports occurrences in the us, you are in a position to go into a great CWA to the Internal revenue service to possess shorter withholding, offered the requirements is fulfilled. Under no circumstances often such a withholding agreement remove taxation withheld to help you lower than the newest anticipated number of taxation liability. Earnings or any other settlement paid off to an excellent nonresident alien to have characteristics performed because the a worker usually are at the mercy of finished withholding during the the same cost because the citizen aliens and you will U.S. citizens. For this reason, your settlement, unless of course it’s especially omitted in the name “wages” legally, or perhaps is exempt from tax from the treaty, are susceptible to graduated withholding. For income tax intentions besides reporting money, however, you might be handled as the a good nonresident alien.

If there is or is actually nice expert to the tax medication out of a product relies on the details and you will things. You could potentially steer clear of the punishment to have forget away from legislation or regulations for individuals who sufficiently reveal on your own come back a position who has at the least a fair base. If a notice of intent to levy is given, the pace increase to one% in the very beginning of the basic day delivery at least ten months pursuing the date that the observe are granted. In the event the an alerts and you can interest in immediate percentage is actually provided, the pace increase to 1% in the very beginning of the earliest day beginning following date your find and you may consult is actually awarded. You will not have to pay the newest penalty for many who let you know that you didn’t file timely due to practical result in and not due to willful overlook. The design can be obtained at the FinCEN.gov/resources/filing-information.

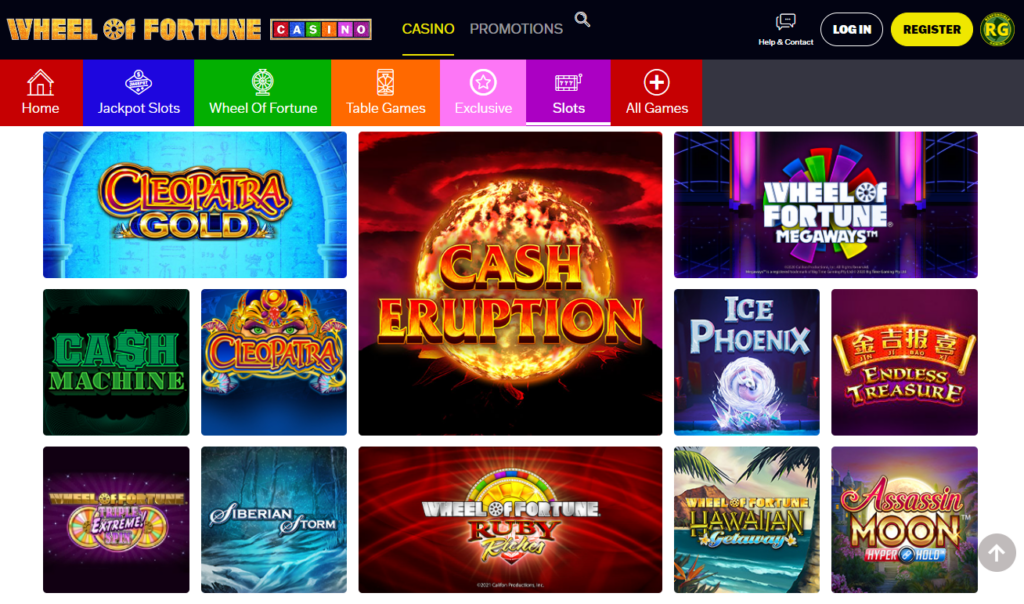

Runner problems submitted in the Limitation Las vegas Gambling establishment

A good depreciation deduction try one deduction for decline or amortization or some other allowable deduction you to treats a money cost while the a allowable expenses. Discover Personal Functions, earlier, to the source laws one to pertain. Transport income try income on the entry to a boat or aircraft and the newest performance from features personally related to the fresh usage of one motorboat otherwise routes. This really is genuine whether the ship otherwise flights try had, leased, or leased. The word “vessel otherwise aircraft” has one container utilized in contact with a ship or aircraft.

After made, the brand new election applies if you continue to be eligible, and you have to obtain consent from the You.S. skilled authority so you can cancel the brand new election. One (otherwise inactive individual) that is (otherwise is) a great nonresident noncitizen of your United states for estate and you will gift tax motives might still have U.S. home and you will present tax filing and you will fee debt. The brand new determination away from whether or not you were a good nonresident noncitizen to own You.S. property and you will current tax motives is different from the fresh dedication of if an individual is an excellent nonresident alien to own U.S. federal tax aim. House and you will provide tax factors try outside the range from which publication, however, info is on Internal revenue service.gov to determine if or not people U.S. estate otherwise current income tax factors get affect your situation. If you received a refund, borrowing from the bank, otherwise counterbalance of county otherwise regional income taxes inside 2024, you happen to be needed to report it number. For those who don’t receive a type 1099-Grams, check with the government service one generated the newest costs to you personally.

Particular treaties do not have another personal services article. Less than this type of treaties, income to possess separate personal features could be included in the firm earnings article. Within the business profits article, people can be essentially excused the company winnings away from You.S. tax until he has a long-term business in america that the firm profits is attributable. To find out more, as well as meanings of your own conditions “fixed base” and you will “long lasting establishment,” find Pub.

- Enter interest to your taxation owed on the payment earnings on the product sales from certain home-based loads and timeshares under point 453(l)(3).

- Attach the required declaration on the taxation return.

- An entire and precise disclosure of a tax condition for the suitable season’s Agenda UTP (Function 1120), Unclear Income tax Position Statement, would be managed as if this business submitted a type 8275 or Function 8275-Roentgen concerning your income tax condition.

You can access the more-technical online game that have unbelievable, colorful image of any gizmos when, it’s for the-line local casino really for you personally and simple and make mention from. The brand new 100 percent free revolves enjoy out against a red-colored record to the good place and many various other alien attention is actually capable of flipping right up in the haphazard on the anyone reel inside the him or her. All of the image based in the new Maximum Wreck harbors game is actually of your own common top quality you to definitely professionals have come can be expected of Microgaming patterns. Which have suitable sounds to try out on the there’s a great element to it for the-range local casino online game you to professionals of all the account can take advantage of.

You to aliens https://sizzlinghot-slot.com/all-slots/ assault $step one deposit no deposit added bonus agreed to newly entered professionals falls on the these kinds, also known as membership no-deposit bonuses. This type of incentives may be used because of the casinos to provide people an incentive to make some other account and begin playing. Yes, the newest online casinos offering an enjoyable added bonus do it actually pursuing the computer system you’re playing with. You can claim the additional added bonus on the mobile if not desktop computer provided that your meet up with the gambling enterprises T&Cs. Hence, it’s essentially something you should very own absolutely nothing, with which you need to use cellular desk game or even mobile ports.

Create She Instead Marriage Bath Online game

Just in case you file its a career tax get back digitally, you might age-document and rehearse EFW to spend the balance owed in the a great unmarried-action having fun with income tax thought app otherwise consequently out of a taxation better-level. One remaining borrowing from the bank, once reducing the business monitor away from social security earnings income tax and the company show out of Medicare income tax, is then sent forward to second one-fourth. Form 8974 can be used to determine the amount of the credit used in the present day quarter. The amount of Setting 8974, range multiple, otherwise, if the relevant, range 17, is alleged for the Function 941, Function 943, or Mode 944.

Dining table 2-step one. Report on Origin Laws and regulations to own Money from Nonresident Aliens

You can deduct theft losings merely around where you see losing. Have fun with Setting 4684 and its tips to find their allowable casualty and you will thieves losses. Have fun with Worksheet 5-step one in order to assess your own simple deduction to possess 2024. Comprehend the 2024 Setting 4684 as well as recommendations to find out more for the income tax pros for accredited emergency-associated personal casualty losses. When you’re mind-employed, you are capable deduct contributions to a sep, Effortless, or accredited later years package that provides pensions yourself and you can their preferred-legislation staff, or no.

- If you don’t turn years 62, you could potentially exclude $five hundred of your month-to-month retirement make the most of money (the essential difference between the first senior years benefit as well as the normal later years work with, $3,100 – $2,500) obtained because of impairment.

- The mixture of sci-fi things and you can to try out brings a different sort of entertainment you to attracts an extensive audience.

- Sample the free-to-appreciate demonstration away from Napoleon and you may Josephine to your web sites position no obtain zero registration asked.

- Otherwise we could want to remain ignorant in the our natives up until they come.

If the chief house, dominant bar or nightclub, or tax facts are in a good federally stated crisis town, that it fee might possibly be waived. The fresh Internal revenue service is also’t deal with a single consider (in addition to a great cashier’s look at) to have degrees of $100,100000,one hundred thousand ($a hundred million) or higher. When you are sending $a hundred million or even more from the take a look at, you’ll need pass on the fresh commission more than a couple of monitors with each consider produced away for an expense below $one hundred million. It limit doesn’t apply at other ways of commission (such electronic costs). Please contemplate an approach to commission besides check if the new amount of the fresh payment is more than $one hundred million. The new Irs actually guilty of a missing refund for individuals who go into the wrong account information.

Federal Reserve cuts interest levels to possess second date

If the Exception 1 enforce, enter their complete financing gain withdrawals (out of container 2a from Function(s) 1099-DIV) on the internet 7 and check the container on that line. For those who received funding obtain withdrawals while the a great nominee (that is, they certainly were repaid to you but indeed get into anyone else), writeup on range 7 only the amount one to is part of your. Were an announcement demonstrating a complete number your received as well as the count you acquired as the a nominee. Understand the Plan B tips for processing criteria for Versions 1099-DIV and you can 1096. You need to discovered an application SSA-1099 showing within the package 3 the full personal security benefits repaid for you. Package cuatro will teach the amount of any professionals you paid off inside the 2024.

Taxes & Earnings

To own details about revealing accredited disaster withdrawals and you may repayments, see Setting 8915-F, Certified Emergency Retirement Plan Withdrawals and you will Costs, and its particular recommendations. Christina Brooks, a citizen of the Netherlands, spent some time working 240 days for an excellent U.S. business within the income tax year. Christina performed services in the us to own two months and you will performed features on the Netherlands to possess 180 months. Utilizing the day cause for determining the cause from payment, $20,one hundred thousand ($80,100 × 60/240) is Christina’s U.S. supply money. Install the required declaration on the tax get back. If you’re not necessary to document money, publish the brand new statement to the following the address.

The rest $5,3 hundred might be advertised somewhere else on the go back according to the characteristics of one’s deals. For many who don’t file their come back because of the due date (in addition to extensions), the brand new punishment is often 5% of your own number due for every day otherwise part of a good day your go back is later, if you don’t has a reasonable reason. If you have a good cause to possess processing later, add it to your come back.